New York’s Proposed Budget Slips In Sweeping Regulation of Non-bank Business Lending and Finance

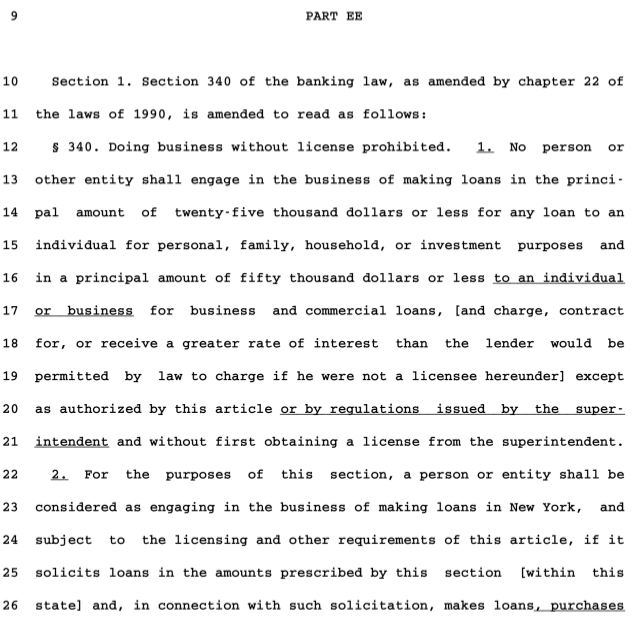

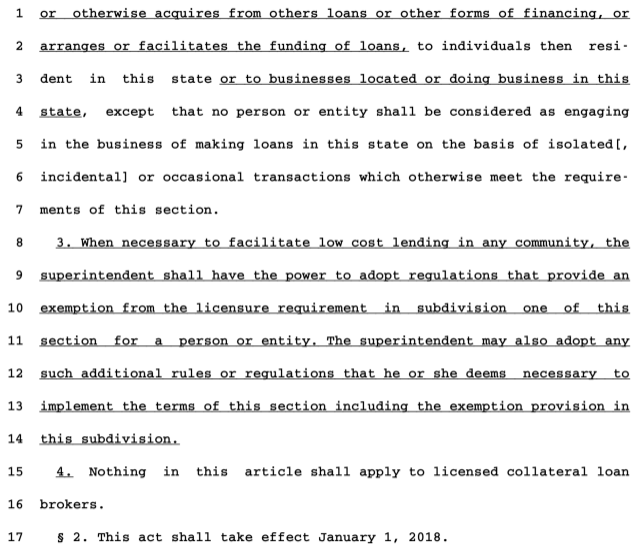

In New York, Governor Cuomo’s 309-page budget proposal includes a handful of sentences tucked in towards the end (Part EE) that would revise Section 340 of the state’s banking law. And the implications are broad, given that it calls for any person or entity involved in the soliciting, arranging or facilitation of business and consumer loans or other forms of financing to be licensed in order to engage in such activity. It appears that MCA companies as well as business loan brokers and ISOs would be directly impacted.

If it passes, the regulator tasked with overseeing that would be the New York Department of Financial Services. It would be effective January, 2018.

For consumer loans, it applies to loans $25,000 and under. For business financing, $50,000 and under.

Last modified: January 30, 2017Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future AltFinanceDaily events here.