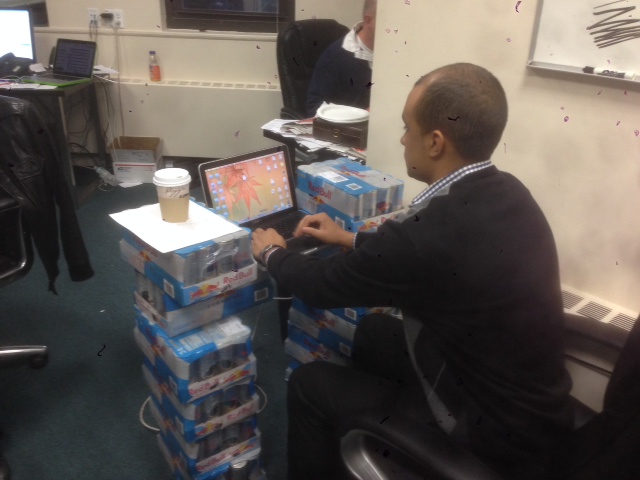

2014 Starts off With a Case of Red bull

Woah, slow down there fellas. Let us digest one thing at a time. We’re not even 2 weeks into the new year and already we’ve learned that:

Woah, slow down there fellas. Let us digest one thing at a time. We’re not even 2 weeks into the new year and already we’ve learned that:

CAN Capital raised another $33 Million (but that they didn’t need it?)

Merchant Cash Advance was the the feature story on the front page of the Wall Street Journal. Seriously…

Bloggers are learning about this industry for the first time. They’re having a bit of trouble getting it right.

PayPal, which just recently kicked off its own merchant cash advance program (or as they call it, their Working Capital Program) has already issued 4,000 advances.

Regulators are freaking out over the use of social media information in loan approvals.

DailyFunder will begin mailing out the first alternative business lending magazine a week from today. It’s free so sign up!

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future AltFinanceDaily events here.